Duty Free Import Authorisation scheme also known as DFIA was introduced in the foreign trade policy so that the exporters could import the raw materials required for the manufacturing of export products in a duty-free manner. The DFIA scheme was introduced on 1st May 2006 and with certain differences, it is almost similar to the Advance Authorisation Scheme making the life of the exporters easier. Duty-free import of products like raw materials, oil, fuel, catalyst, energy resources etc which is required for the production of export goods are allowed in the license issued under the DFIA scheme. Different import export courses online have many concrete materials on DFIA and in this article, we will be covering all the major aspects of DFIA in detail.

Eligibility criteria for Duty Free Import Authorisation scheme

There are some eligibility criteria decided and made mandatory by the government for Duty free import authorisation scheme which are as below

- The DFIA licence will be awarded once the product has been exported if standard Input-Output Norms have previously been notified

- DFIA licenses are available to both manufacturers and merchants exporting goods. According to the GST requirements, merchant exporters must include the name and address of the supporting manufacturer in all export documents such as shipping bills, bills of export/tax invoices.

- Before beginning to export under a duty-free import authorisation, the applicant must submit an application to the relevant DGFT RA.

- An import that is subject to a pre-import condition will not be granted a duty-free import permit. DFIA licences will not be provided for genuine user conditions or items listed in Appendix 4J, such as spices, tea, coconut oil, precious metals/Gold/Silver/Platinum, and so on.

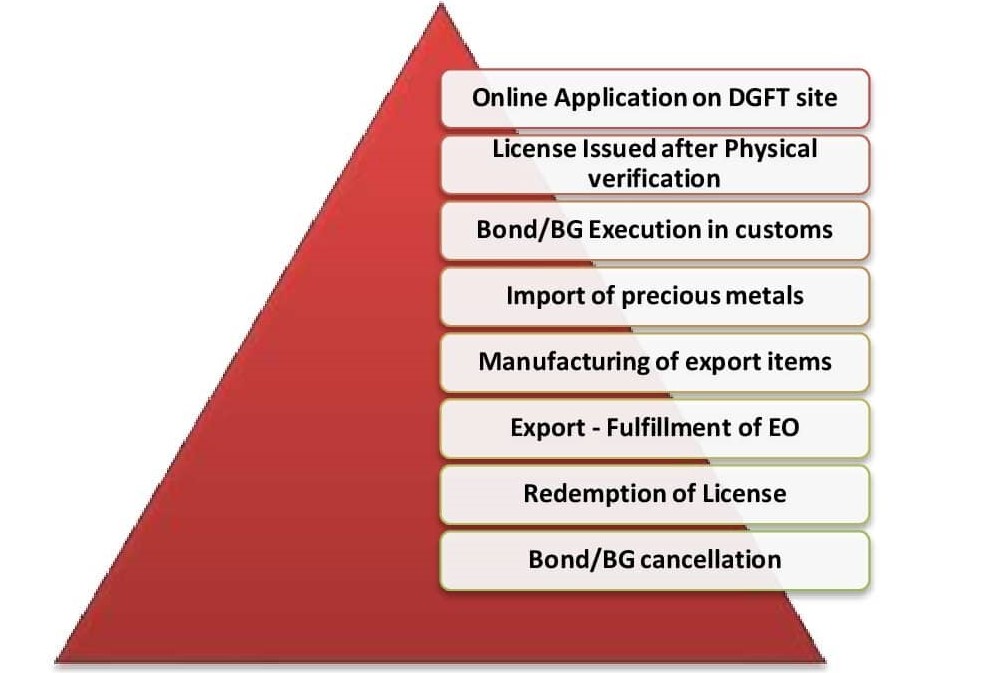

Steps to be followed for Duty Free import Authorisation scheme

There are certain steps that must be followed under the Duty Free Authorisation Scheme which are as below

- Before beginning to export under the Duty Free Import Authorization, the applicant must submit an online application to the regional authority. When the application is submitted, a file number is produced.

- The export must be completed within 12 months of the date of the online submission of an application for Duty Free Import Authorization.

- When exporting items, the applicant must provide the file number on all export papers such as ARE-1, ARE-3, Shipping Bill, Airway Bill, Bill of Export, and so on.

- The DGFT RA will review the provided documentation and, if they are clear, will issue the transferable DFIA licence within 20-25 days.

- Once the DFIA licence has been given by the DGFT RA, the DFIA licence must be registered in customs for verification reasons.

- The applicant can apply to the appropriate Regional Authority for the issuing of a transferable Duty Free Import Authorization once the export has been completed and the revenues have been realised. The request must be made within 12 months of the date of export, or within 6 months of the date of realisation of export revenues, whichever comes first.

- Each SION and each port will require a separate Duty Free Import Authorization (DFIA).

- One of the important points to be noted here is that exports under the Duty Free Import Authorization should all come from the same port.

- For the export of items when SION specifies Actual User condition for any input, a Duty Free Import Authorization will not be provided.

Domestic procurement of inputs

The bearer of a Duty Free Import Authorization can get inputs from a domestic provider instead of importing directly. Domestic inputs can be purchased using an Advance Release Order or an Invalidation Letter.